Roth 401k early withdrawal calculator

You can find out how much your 401k will grow without the help of a financial wizard. Early 401k withdrawals will result in a penalty.

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Participants in a traditional or Roth 401k plan are not allowed to withdraw their funds until they reach age 59½ with the exception of withdrawing funds to cover some hardships or life events.

. But in some cases your plan may allow you to take a penalty-free early withdrawal. It is also possible to cash out retirement plans though this usually results in early withdrawal penalties and taxes. Early Withdrawal Costs Calculator.

If you tap into it beforehand you may face a 10 penalty tax on the withdrawal in addition to income tax that youd owe on any type of withdrawal from a traditional 401k. Present Value of Annuity Calculator. The reports which will examine the period between February 2020 and the US.

On top of that the IRS will assess a 10 early distribution tax penalty and the conversion will ultimately not take place. Exceptions for Both 401k and IRA. 401K Roth IRA Roth 401K - Need advice please.

Your 401k is your money and making a withdrawal is as simple as contacting Fidelity to let them know you want it. With a Roth 401k income taxes only. 401k Withdrawal Rules.

Exceptions to the Early Withdrawal Penalty. However you can also reach out via phone if you prefer. What is the after tax impact of switching from a traditional IRA to a Roth IRA.

Withdrawals must be taken after age 59½. If you return the cash to your IRA within 3 years you will not owe the tax payment. Traditional 401k Withdrawal Rules.

With a traditional 401k you pay income taxes on any contributions and earnings you withdraw. A 10 early. Making a Fidelity 401k Withdrawal.

Minus any non-deductible contributions will be taxable in the year received. The early withdrawal penalty is 10 of the taxable amount you take as an early distribution from an individual retirement account IRA a 401k a 403b or other qualified retirement plan before reaching age 59½. Early withdrawals from IRAs or 401ks are both subject to a 10 penalty along with standard income taxes.

The IRS may waive the 60-day. Early withdrawals from. Why do you do 401k - traditional IRA - Roth IRA instead of straight 401k - Roth IRA.

Confused choosing between. Call 800-343-3543 with any questions about the process. The Roth 401k brings together the best of a 401k and the much-loved Roth IRA.

You die or become permanently disabled. The IRS allows penalty-free withdrawals from retirement accounts after age 59 ½ and requires withdrawals after age 72. This simple 401k Calculator will show what role your 401k will play in plotting your path to your golden years.

Before making a Roth IRA withdrawal keep in mind the following guidelines to avoid a potential 10 early withdrawal penalty. 401K and other retirement plans. You will be free to make a withdrawal from.

These are called required minimum distributions or RMDs There are some exceptions to these rules for 401k plans and other qualified plans. The main difference is the income taxes you pay on your contributions. Tax-free and penalty-free withdrawal on earnings can occur after the age of 59 ½.

The Costs of Early 401k Withdrawals. It shares certain similarities with a traditional 401k and a Roth IRA although there are important. Once you pay the income tax and early withdrawal penalty on your funds you are likely to only be left with about 60 of the money that you removed from your account.

Simply provide the required inputs variables and quickly calculator what your 401k will grow to in the future. SIMPLE 401k for businesses employing fewer than 100 people Safe Harbor 401k in which employees always own 100 of any money their employer contributes Traditional 401k popular with companies that have large workforces One-participant 401k. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match.

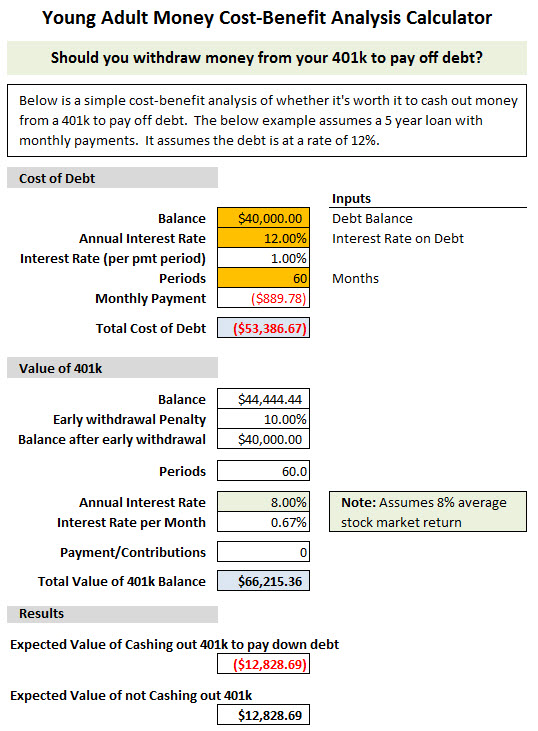

A Roth IRA early withdrawal often has fewer restrictions and penalties than a traditional IRA distribution if you need access to your retirement savings before age 59 12. Not A Math Whiz. 401k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Use this calculator to estimate how much in taxes you could owe if you take a distribution before retirement from your qualified employer sponsored retirement plan QRP such as a 401k 403b or governmental 457b.

The easiest way is to simply visit Fidelitys website and request a check there. Roth 401k vs. 401K Roth 401K Roth IRA or Traditional IRA.

Assuming i am happy with my current 401k low manegement fee 0019 ish with good performance. Withdrawals must be taken after a five-year holding period. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years.

These payments must last a minimum of 5 years or until you reach the normal 401k withdrawal age of 59 12 whichever is shorter. Roth IRA withdrawal and penalty rules vary depending on your age and how long youve had the account and other factors. It seems redundant to do the indirect transfer while you can do the direct transfer from 401k - roth IRA if the 401k plan allows to roll over to roth IRA.

The 401ks annual contribution limit of 20500 in 2022 27000 for those age 50 or older. A Roth 401k is an employer-sponsored retirement plan thats funded by after-tax dollars. Withdrawal in August 2021 have been done for weeks but are still going through review and declassification.

Several variations of tax-deferred 401ks exist. Strategy for Roth 401k to Roth IRA conversion and withdrawals. Early withdrawal rules are very similar for both Roth 401ks and traditional 401ks.

While you still have to pay taxes on any money taken out of a 401k or IRA before a certain age there are some circumstances that would let you get around the 10 early withdrawal penalty for retirement funds. This 401k Early Withdrawal Calculator will help you compare the consequences of taking a lump-sum distribution from your 401k or even your IRA versus rolling it over to a tax-deferred account. Roth IRA Calculator.

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. Others may move their assets into their new employers plan. Tax-deferred 401ks reduce taxable income now.

Once you reach age 595 you may withdraw money from your 401k penalty-free. With a Roth IRA you can withdraw up to 10000 to buy build or rebuild a first home and avoid paying taxes and the 10 percent early withdrawal penalty even if you are under age 59 ½.

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

Pin On Financial Independence App

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

401k Calculator With Employer Match Tax Savings In 2022 The Real Law Of Attraction Manifestation Methods

401k Tips For Beginners Financial Coach Saving For Retirement Retirement Savings Plan

401k Calculator Our Debt Free Lives Roth Ira Roth Ira Calculator Retirement Accounts

Safe Withdrawal Rate For Early Retirees 401k Withdrawal Retirement Calculator How To Plan

401k Calculator

Traditional Vs Roth Ira Calculator

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

Read About My Favorite Retirement Calculator Firecalc Retirement Calculator Retirement Money Retirement Savings Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

401k Retirement Withdrawal Calculator Clearance 50 Off Www Ingeniovirtual Com

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account